Angel investor programme

Angel investors provide knowledge, contacts, and capital to entrepreneurs and companies and are therefore important for the Swedish business community. It is thus natural for Saminvest to support Sweden’s angel investors.

Saminvest’s angel investor programme helps develop the venture capital market and the investor community. This is because the angel investor programme strengthens and supplements the financing for hundreds of companies in development phases and engages hundreds of angel investors throughout Sweden. Saminvest’s investments in angel investors are based on commercial viability. The angel investors also contribute to increasing the sustainability of the business community. Saminvest also requires and follows up to ensure the angel investors actively work for increased gender equality and sustainable entrepreneurship.

The angel investor programme is linked to some of the country’s leading incubators, which have spent many years developing expertise, networks, and infrastructure. All of these incubators are part of Vinnova’s national incubator program and are classified as excellent. They have a strong flow of companies moving through them and good connections with angel investors. Saminvest collaborates with Arctic Business in Luleå, Ideon Innovation in Lund, Minc in Malmö, Sting in Stockholm and Uppsala Innovation Centre. Together, we create the conditions for new companies to grow and become successful. The majority of the incubators and certain angel investors are at the forefront of actively supporting and helping improve, among other things, gender equality among their teams and the senior executives of their portfolio companies, as well as the integration of sustainability in the companies’ business models.

Overview

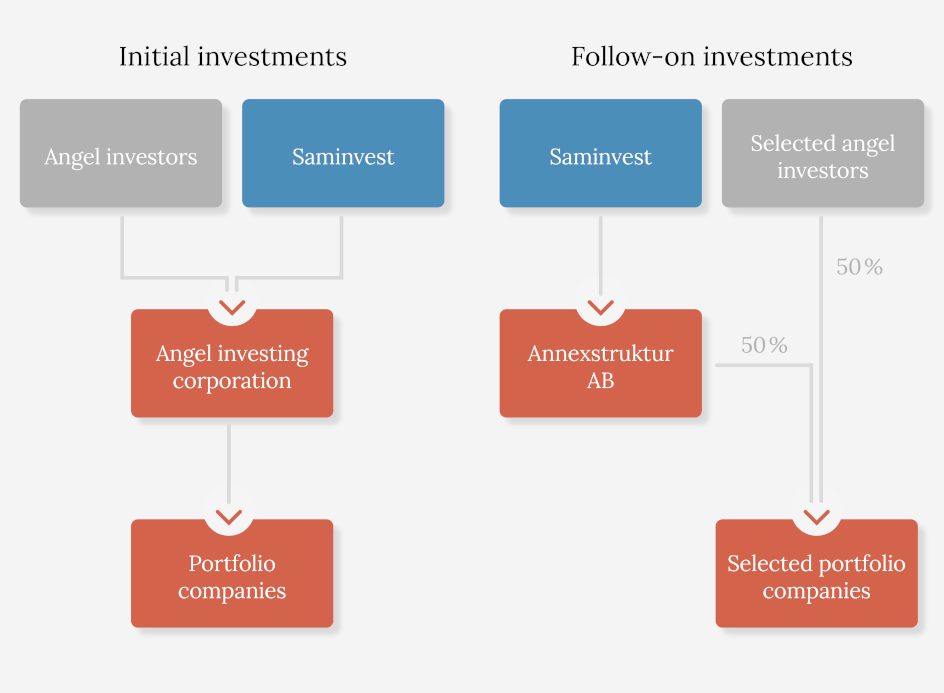

Initial investments

In the first step, Saminvest and angel investors invest together in an angel investing corporation, which in turn invests in and builds a portfolio of start-up companies that undergo an incubator program. The angel investors thus gain, with a relatively small capital investment, an increased spread of risk in their investments as well as insight into and contacts with a large number of promising start-up companies.

Follow-on investments

In the second step, the angel investors evaluate which of the portfolio companies from the angel investing corporation they want to continue investing in and then make one or more follow-on investments in those companies. Some selected angel investors’ investments are matched by Saminvest. This is done for the same amount and on the same terms for each angel investor. Saminvest does not exercise any ownership power in these companies, but it is transferred to the selected and co-investing angel investor.